So, you’re thinking about getting into Forex trading. You heard about the crazy money you can make in the markets, and you want to get in on the profits. You decided to start Forex trading, penny stocks, options, maybe even crypto currencies. Many of us think, “If everyone is making money, I can too.” Yes, it is possible to make a lot of money from Forex trading, but you need to be aware of the risks and strategically manage them.

Trading Risk: Uncertainty and the Unknown

My kids once asked me, “Dad, if you had a superpower, what would it be?” I immediately answered, “The ability to see 5 minutes into the future!” Of course, that wasn’t what they expected to hear, so they looked confused. I merely pointed out that my job as a professional trader would be much less risky if I had that power. There would never be any risk of loss or need for Forex risk management because I would KNOW what the market will do in the next 5 minutes.

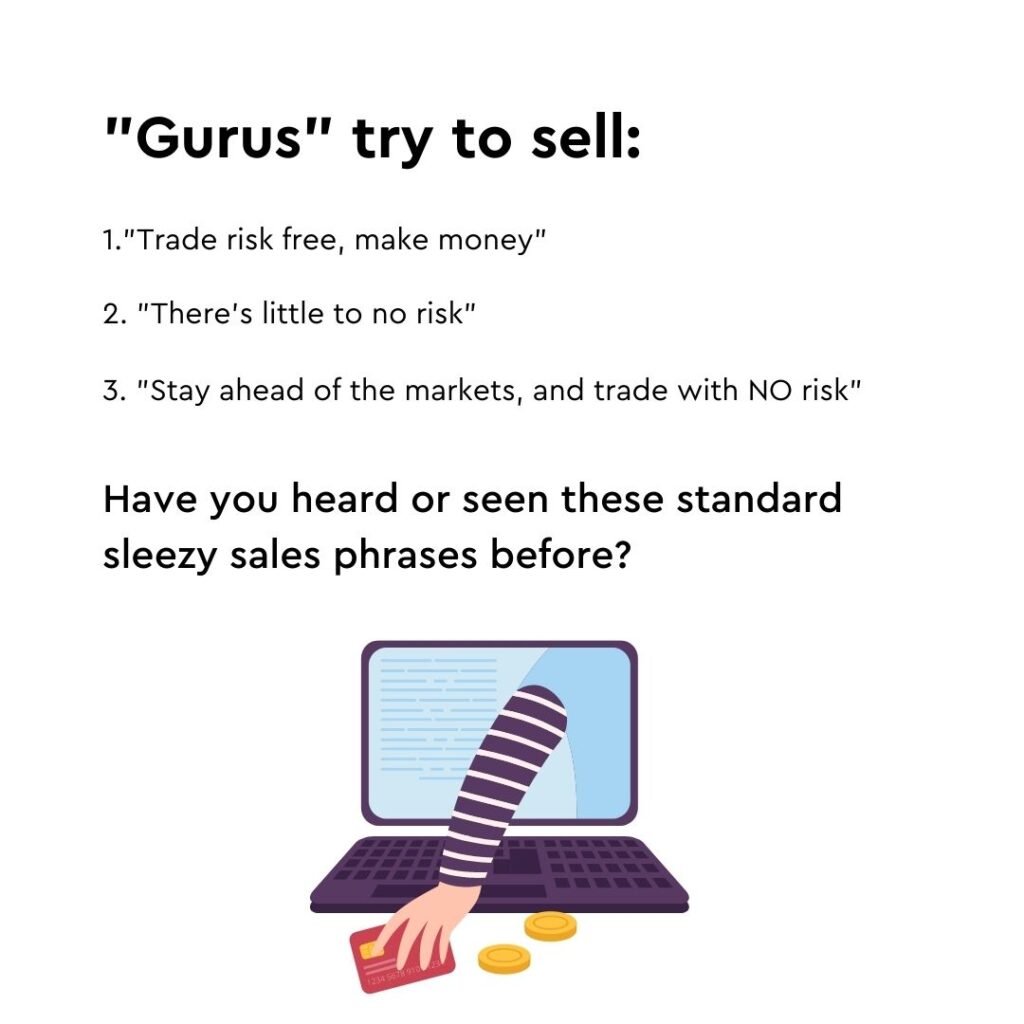

We all know that it is impossible to consistently predict the future. There will always be the Risk of uncertainty and the unknown. Ironically, I have heard traders trying to sell their signals or their trading strategies to novice traders by using phrases like:

- “Trade risk-free, make money”

- “There’s little to NO risk!”

- “Stay ahead of the markets and trade with NO risk!”

Anyone who has been in the world of trading long enough can easily spot the illusion about trading with “no risk.” But, it’s understandable to want that to be true!

The Truth is, Risk has two Sides

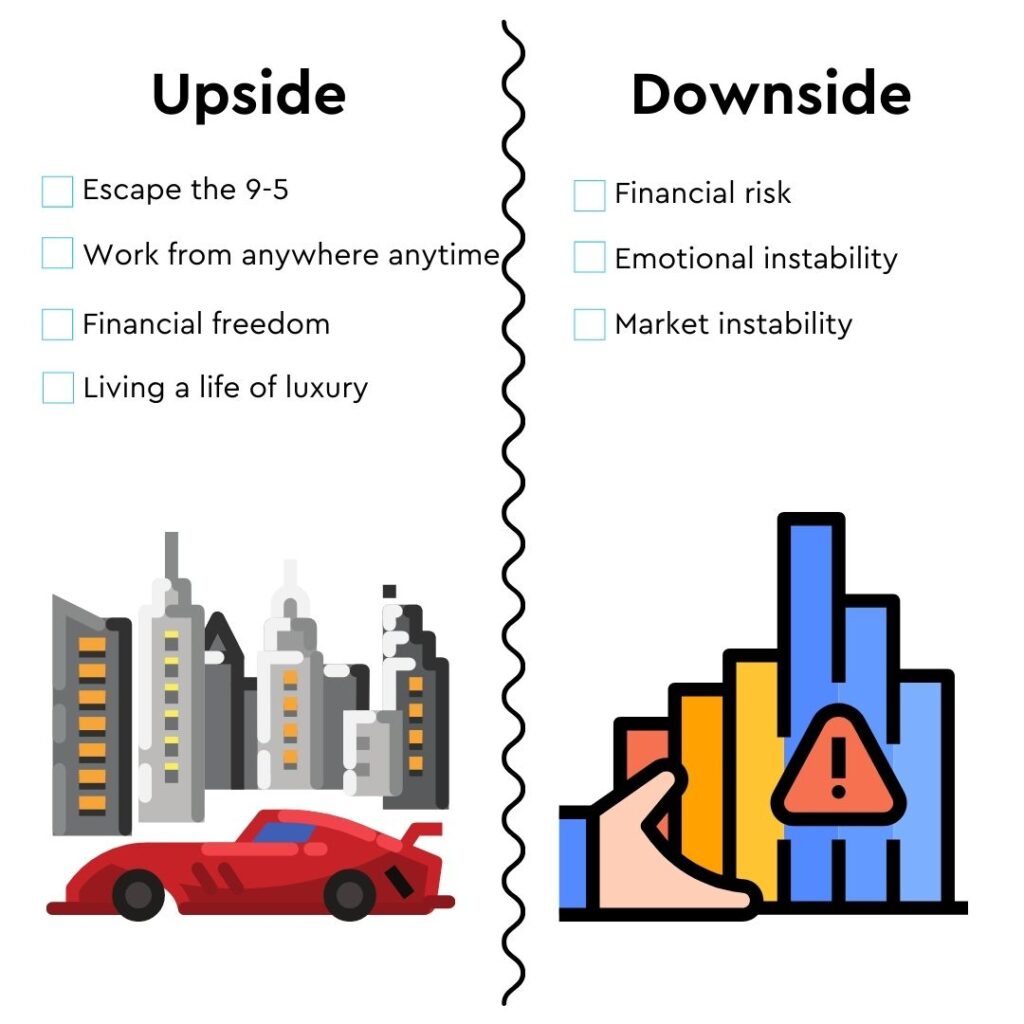

Downside:

Risk is potential pain, hurt, or struggle. It is built into our human brains to protect ourselves from such things. We’ve labeled these pain points as most traders I know are human, so we all try to avoid pain, hurt and struggle as much as possible.

Every time you press that buy or sell button, you’re putting your money at Risk. No matter how great your strategy is, no matter how awesome your friend is at trading who told you what to buy or sell, no matter how excellent their track record is, you stand to lose some money.

Possibly, ALL of your money.

Upside:

Although we highlight threats to a trader’s success, we do want to emphasize that Forex trading is a great path to escaping the 9-5, financial freedom, and you can trade from anywhere in the world. Do you want to live a life of luxury? Do you love to travel, want to own designer clothes, or do you fantasize about driving an exotic car? Trading Forex can get you there. The sky’s the limit and if you’re willing to be disciplined you can live a very luxurious life.

Have I painted a clear enough picture? Before you scour the internet looking for a resource to help you get started, let me introduce you to risk management.

What is Risk Management?

Risk management is important because it protects you from the pain of losing everything, your money, your discipline, and your self-respect. Essentially, it’s pain management. If you can manage the intensity of the pain you may feel from taking a loss in your trading, while the sting of that pain is still there, it can be greatly reduced.

In fact, that pain can eventually disappear if you approach your trading correctly. “Really?” I can hear you say, “Tell me how!” Well, I’ll tell you.

Risk Management. (cue *eyeroll*)

What is forex trading risk management and how does it help?

Forex trading risk management is:

- Identifying

- Planning

- Controlling

for losses to your trading capital and potential profits. Yes, you read that right. Control! Let’s look into this.

In the markets, a trader has little control over the profits you make. If we did, we’d all be billionaires by now. Wouldn’t it be great if we hit our daily profit target every day? The market doesn’t work this way. You don’t control what your profits will be. Instead, you can control how much you lose.

Risk is the one thing you CAN control. You can control: the amount of overall risk you take, how much money you lose on each trade, and how much you lose overall before you have to take a step back and reassess your trading strategy.

Why Forex Trading Risk Management

On paper, forex trading risk management sounds easy. In reality, it’s hard because fears and emotions start to get in the way. Emotions can make you break your own trading rules and forget all about your risk management plan. Trading risk management is more than just controlling losses. It includes being emotionally aware, having a trading strategy before a single trade is made, and reviewing your trading results so that you can make adjustments.

Setting Expectations Through Risk Management

Focusing on the risk management component of your trade plans, you are setting proper expectations for yourself and for that part of your brain that is wired to protect you from pain, hurt, struggle, and you can warn yourself of that potential pain. Your forex risk management, as part of your overall forex trading strategy, is that warning. Eventually, as you start to follow proper risk management practices, you are ready for the pain.

Some would argue that this pain cannot be lessened; even the most seasoned professional trader still feels pain at a loss. But with many years of following proper forex risk management, you’ll survive long enough in the markets to build calluses to the pain, possibly even embrace it as an essential part of investing.

I remember a story from a long-time professional commodities trader, Larry Williams, who made this point of getting used to trading losses and feeling that pain. He was helping his dad with some beehives and was all covered up in his protective gear, but his dad wasn’t. He said, “Dad, why aren’t you wearing any protective clothes? You’re getting stung!” And his dad responded, “Oh, I’ve been stung so many times that it doesn’t bother me anymore.”

Looking Forward with Proper Forex Trading Risk Management

Forex trading will be hard as anything worth doing is, but the views from the top are tremendous. Forex appears to be a “get-rich-quick” scheme as self-proclaimed “gurus” try to sell you on their training courses from the hood of their sports car holding $10k in cash. This is not the image we want to be portrayed.

We agree with “gurus” on one thing; Forex trading can make you a very wealthy person. You don’t have to rely on anyone to get there either. But we fundamentally disagree that it will help you get rich quickly. Forex trading is not easy; it takes discipline, emotional regulation, and taking on quite a bit of risk. Forex doesn’t generate “overnight successes”. The best in the business have been perfecting their risk management and trading strategies for years.

Our forex trading risk management strategies have culminated from over 20 years of combined experience amongst our team. Our collective knowledge seeks to protect you from yourself. I know, it’s interesting. When you make a wrong decision, our strategies (if utilized properly) will keep you from losing everything. Remember, trading is a marathon, not a sprint. Consistent action over long periods will get you across the finish line.