*Click* *Snap* *Zip*

There is a comforting feeling of protection when you click your helmet into place before you ride an ATV or mountain bike. Likewise, when you sit in your car and click in your seatbelt before driving on the interstate, you feel a sense of security that allows you to focus on the rules of the road rather than the possibility of getting into a crash. I’ve never jumped out of a perfectly functioning airplane, but I imagine if I did, I’d be much more confident in jumping out if I had a parachute securely zipped up. I like to have that feeling when it comes to forex risk management.

There is something important in common with the click of a helmet, the snap of a seatbelt, and the zip of a parachute.

Safety Comes First!

Important questions I ask Forex traders who are getting started with risk management:

- Do you know how to keep your capital safe?

- Do you know what you’re risking?

- If you don’t, why would you ever enter the market without knowing that?

- Would you jump out of an airplane without a parachute?”

Can you see the similarity?

No one in the right mind would jump out of a perfectly good airplane without a parachute, would they?

No successful forex trader jumps into the markets without a plan to get out, managing risk, and knowing what they are putting at risk.

“Why would you ever do that?”

Understanding that comparison and other similarities in life is the first step in developing good forex risk management. Risk abounds in many activities of everyday life! For example, driving a car, walking across the street, riding an ATV, ice climbing, mountain biking, swimming in the ocean, etc.

Each one of us learns how to manage the risk of everyday life in many different ways. We can learn by our own experience, we are taught by others like parents, family, teachers, and friends. “Don’t touch that stove; it’s hot, and it will burn you!” “Look both ways before crossing the street, or else you could be hit by a car!” So, how do we learn how to trade with proper forex risk management? The same way.

Getting Started- The How

4 steps will help you decide on how much you should risk.

- Practice

- Plan

- Execute

- Evaluate

Practice

Every trader should practice their trades in a demo account before trading real money. You will experience losses in your trading, so it is easier to determine what your risk should be within your trading plan by losing trades with no real monetary connection.

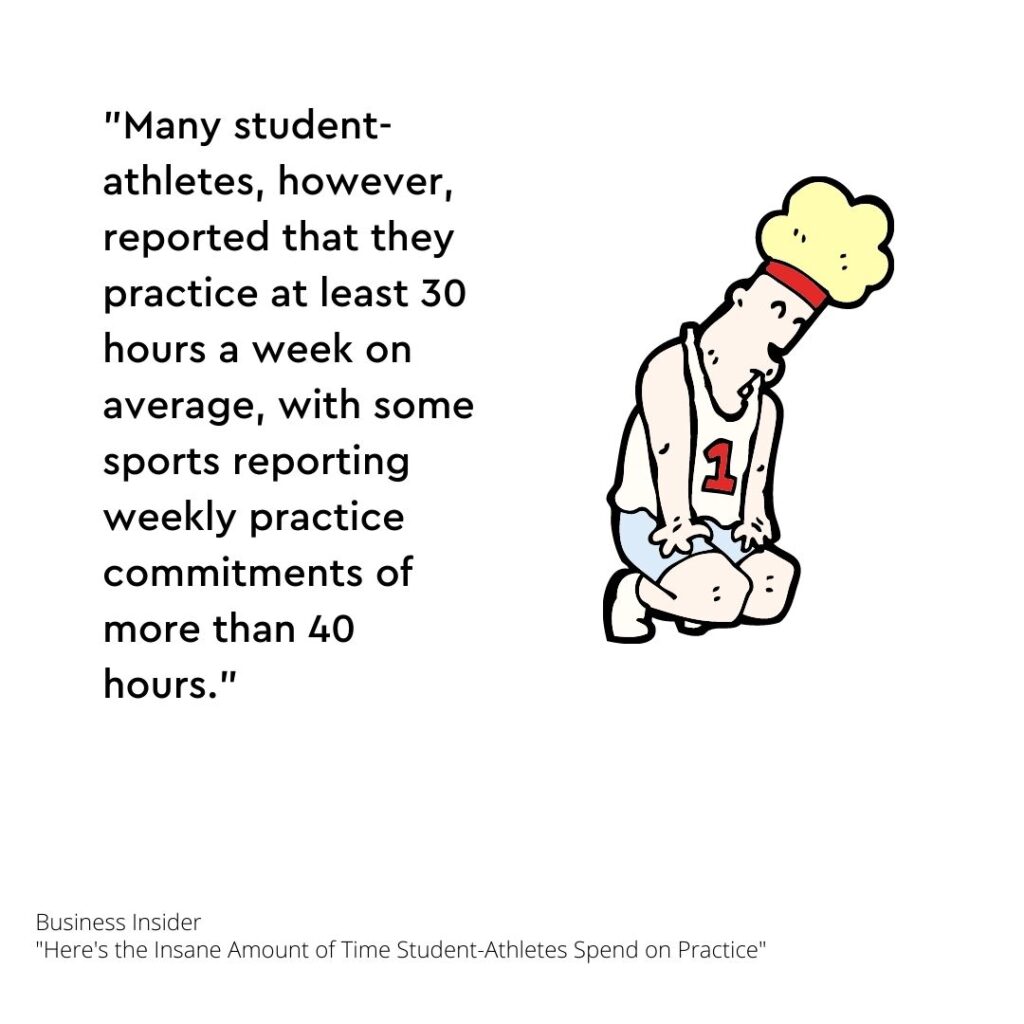

If you follow sports, you may have noticed that most sports teams and athletes spend more time practicing than competing in their actual game. They spend more time on the practice field or in scrimmage than in an actual live event to prepare. So should we as traders spend much of our time in the practice accounts, especially if we are not ready for the real thing. Continuing with our jumping out of a plane example, many sky-divers do not jump out by themselves when they are first learning. Instead, they are latched to an experienced jumper, one who has done it many times before.

During our purposeful practice, we practice strategies to determine a statistical edge. Part of this strategy includes where to enter the market, how many lots, where to place our profit targets, and where to place our stops. Also, we need to know how much to risk!

Many traders practice trade while following an experienced trader. They place their entries, stops, and targets at the same place. This is not only acceptable but it’s also recommended. That is considered purposeful practice.

If, with enough effective practice, we can learn from others and from our own experience how much to risk during our practice trading, then developing a sound and protective trade plan will be much easier.

Plan

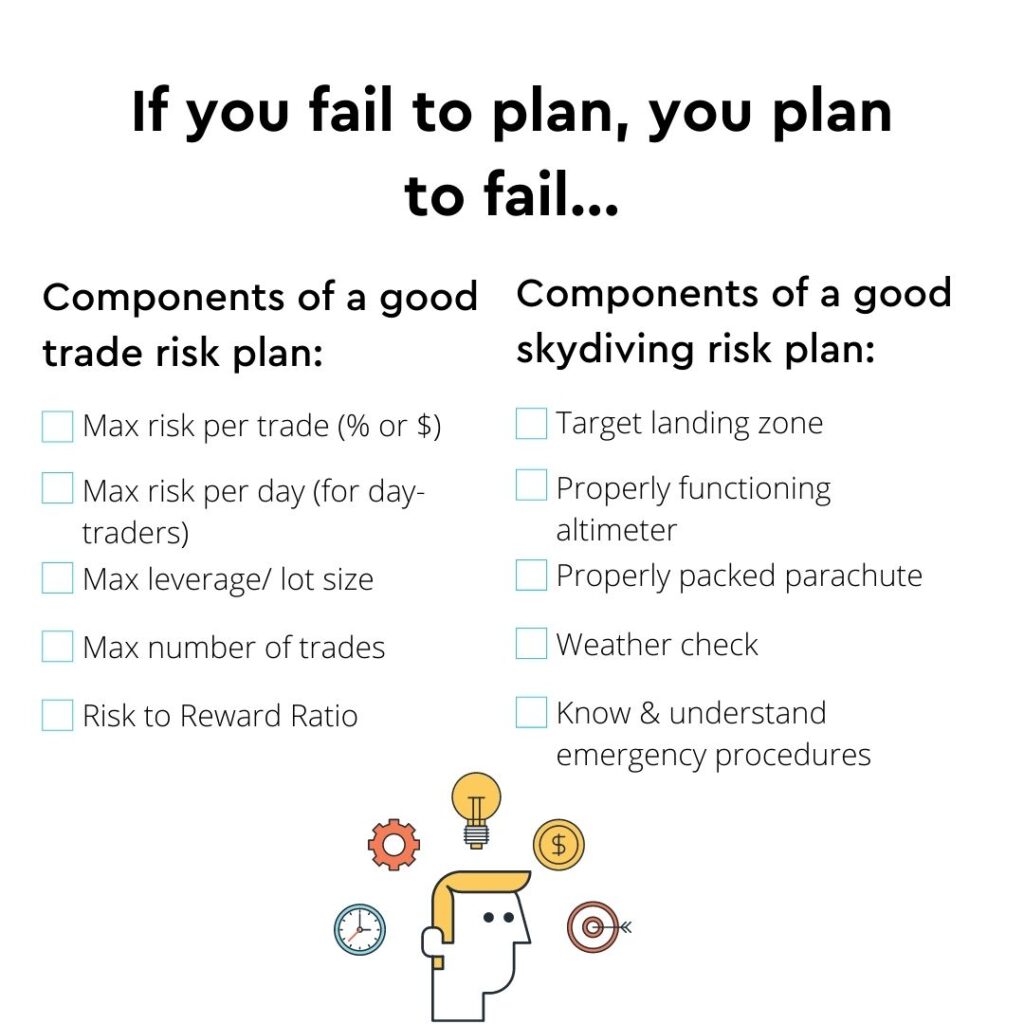

Developing and writing out your trade plan is an essential part of successful trading. Remember the adage “if you fail to plan, you plan to fail”? Well, that is certainly applicable in trading. It may be more valuable than you think.

Trading without a plan is one of the most significant risks you can take in your trading. It is like jumping out of a plane without a parachute; eventually, you will hit the ground, and without a parachute, the result will not be a positive one.

When you develop a trading plan which outlines and defines your max risk per trade, you are essentially zipping into place your parachute. With that plan, you put in place protection that your trading strategy and, ultimately, your trading capital needs for you to become a long-term success. Some of the components of a good risk plan can include:

- Risk per trade (this can be by percentage (%) or by dollar amount ($))

- Per Day Risk (for day-traders)

- Leverage/ Lot Size

- Number of trades

- Risk: Reward Ratio

Execute

A plan is only as good when it is implemented. A plan doesn’t make much sense if it’s not used or properly executed. Practicing your plan in a demo account will help you develop good habits to manage your plan correctly. This is one of the purposes of trading in a demo account: to learn how to execute your trading strategy.

Trading successfully requires much practice of many different skills. Chart reading or technical analysis, fundamental analysis, managing emotions, money management techniques, and, of course, learning to be disciplined to your risk rules. The practice of executing sound forex risk management rules will help solidify the right trading behaviors.

Evaluate

As you execute your strategy, you will find errors in your plan and your performance. You must track your statistics and keep a trade log or journal to pinpoint common mistakes and areas of improvement. Doing so will help you identify where you can improve upon and develop better execution.

Evaluating your errors, whether due to the market conditions, your risk parameters, or your improper execution of your risk rules, will help you become a better trader. Once you have some data to work with, you can evaluate what changes are needed to manage your risk.

Getting Started with Forex Risk Management & Powering Through

The difficulty in getting started with forex risk management is that most traders won’t put the time in to go through these steps. They don’t believe it is necessary, or it may take too long to do, or it isn’t worth the trouble of doing it. Some may not even know where to start. This is why we’ve created [these risk management tools]. Successful traders will push through any excuse that prevents them from protecting themselves against the unknowns of the markets and their own emotions that come from trading.

When following these steps, traders ensure that they are clipping on their helmets & seat belt and strapping on a protective parachute. As a result, they ensure that they will protect themselves from unnecessary risks while trading the markets.